The Latest FinCrime News about Technology

-

FATF Addresses Global Surge in Cyber-Enabled Fraud and Digital Risk

The FATF identifies cyber-enabled fraud as a critical global threat, urging jurisdictions to implement rapid asset recovery and stricter digital standards for mitigating cyber-enabled fraud risks through global AML standards.

-

The Hidden Danger of Data Decay in Modern Banking Systems

Financial institutions face massive regulatory penalties when KYC Data Quality issues and internal data decay prevent compliance teams from detecting sophisticated money laundering.

-

The 2026 State of AML Vendor Consolidation

AML vendor consolidation trends are reshaping compliance technology as funding slows, valuations compress, and private equity accelerates acquisitions across anti financial crime platforms.

-

The Sumsub Incident and the Future of Cloud Compliance

The Sumsub security incident demonstrates the inherent data breach risk when using third party cloud providers for identity verification and transaction monitoring services.

-

Scaling Federated Learning Networks for Global Anti Money Laundering

This article examines the shift toward secure federated learning and collaborative modeling in anti money laundering efforts as institutions adopt distributed intelligence to overcome data silo limitations in 2026.

-

Revolutionizing Financial Crime Detection with Integrated Data Graphs

Modern financial crime requires modern tools. This article explores how Data Graphs merges KYC, transaction, and blockchain data to uncover complex laundering schemes and hidden networks that traditional systems miss.

-

How Australian Operation Taipan Crushed a 62 Million Dollar Syndicate

Operation Taipan and Global AML Strategies exposed a massive money laundering network that moved 62 million dollars through ATMs, resulting in major prison sentences and a total overhaul of Australian financial intelligence protocols.

-

Understanding the South Korea Update on Cloud Rules vs DORA

The South Korea update on network separation rules improves Digital Resilience and directly compares to DORA standards for financial cloud security and third party risk management.

-

Unsupervised Machine Learning Models in AML Don’t Discover Crime They Manufacture Alerts

A critical analysis of how unsupervised models in AML often manufacture useless alerts rather than discovering real criminal risks through opaque mathematical models and biased design choices.

-

Digital Identification Risks in the Era of Deepfake Technology

The collapse of facial biometrics as a secure anchor is creating massive AML exposure. Learn how deepfake identity fraud bypasses ID&V systems and what firms like Revolut are doing to stop impersonation scams.

-

Is X the New High Risk Frontier for Global Money Laundering

Industry leaders raise alarms over the lack of Know Your Customer protocols as X moves toward crypto trading. The platform faces major AML hurdles in its expansion.

-

DORA Compliance For AML Vendor Security Standards Using Public Cloud

DORA mandates that AML vendors using public cloud services implement strict safeguards to protect confidential information and maintain professional secrecy.

-

Sanctions Evasion in the Age of Crypto, Shell Companies, and AI

Sanctions evasion now uses crypto, shell companies, and AI, forcing institutions to adapt their compliance frameworks to detect rapidly evolving threats.

-

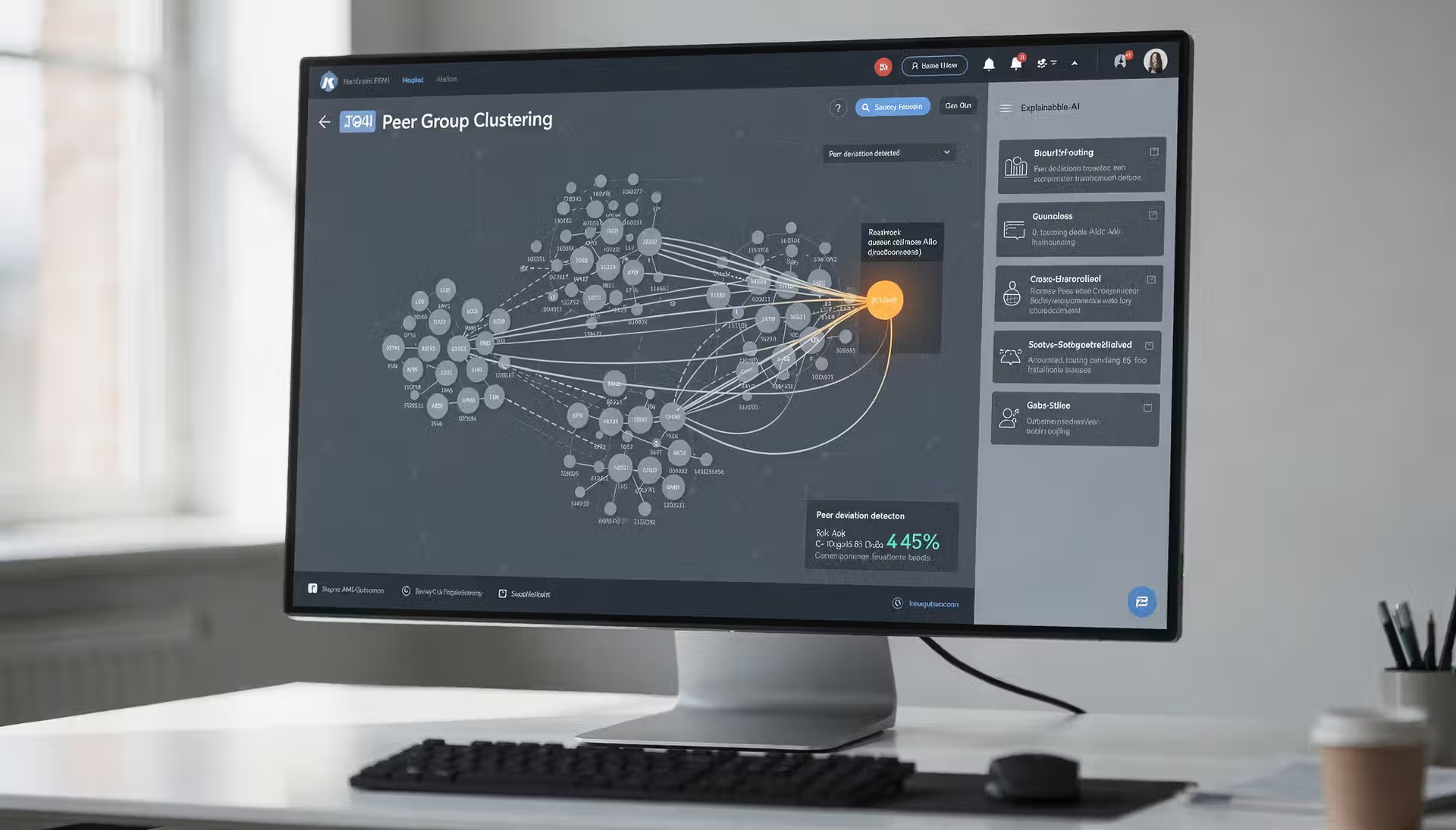

Advancing Financial Integrity through AI Peer Group Comparison

Discover how AI Peer Group Comparison is changing transaction monitoring and the risks that biased data sets pose to financial institutions globally.

-

Why AML Software Replacements Fail and How Financial Institutions Recover

An analysis of AML software replacement failure and how weak governance, data gaps, and rushed timelines derail compliance transformations.

-

Why One AI Logic Can Create 2 Different Biased AML Worlds

This article examines how configuration drift and systemic AI bias lead to divergent AML results across identical banking software environments, highlighting why different data ecosystems produce conflicting risk assessments for the same financial behaviors.

Other News About Technologies

FATF Addresses Global Surge in Cyber-Enabled Fraud and Digital Risk

The FATF identifies cyber-enabled fraud as a critical global threat, urging jurisdictions to implement rapid asset recovery and stricter digital standards for mitigating cyber-enabled fraud risks through global AML standards.

The Hidden Danger of Data Decay in Modern Banking Systems

Financial institutions face massive regulatory penalties when KYC Data Quality issues and internal data decay prevent compliance teams from detecting sophisticated money laundering.

The 2026 State of AML Vendor Consolidation

AML vendor consolidation trends are reshaping compliance technology as funding slows, valuations compress, and private equity accelerates acquisitions across anti financial crime platforms.