An exclusive article by Mohan Paranthaman

Germany’s financial regulatory environment, led by BaFin (Federal Financial Supervisory Authority), is entering a new era of proactive enforcement. BaFin’s 2026–2029 strategy emphasizes early risk detection, AML/KYC compliance, operational resilience, and stronger data integrity across all financial institutions.

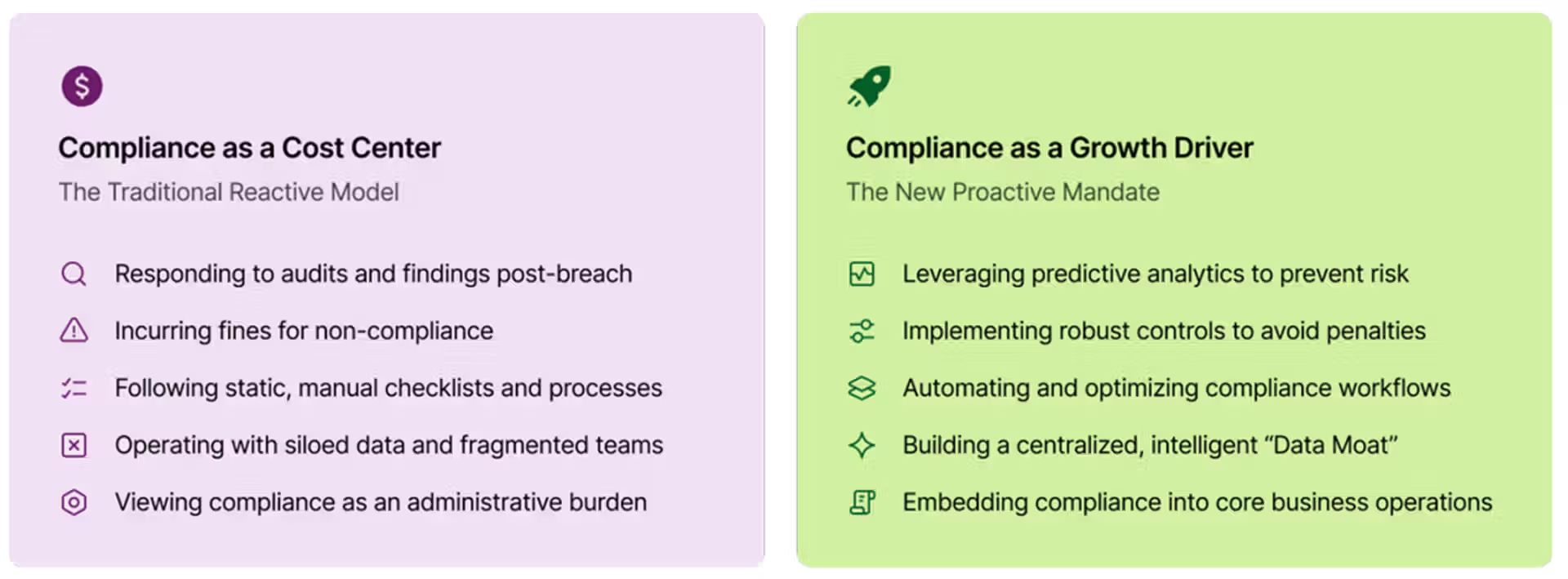

For banks, AML and KYC compliance can no longer be viewed as administrative tasks. BaFin enforcement now targets not only money-laundering breaches but also structural and technological weaknesses that create systemic risk.

Forward-looking institutions are adopting RegTech solutions and AML software to modernize their AML transaction monitoring and KYC processes. This article provides a blueprint for transforming compliance under BaFin’s tougher standards, covering governance, AML monitoring, and data-driven workflows that define the next generation of RegTech-enabled banking.

Table of Contents

The Why: BaFin’s Evolution – From Crisis to Systemic Control

BaFin’s enhanced assertiveness in supervising Germany’s financial sector is a direct consequence of past crises. The collapse of Wirecard in 2020 exposed grave oversight lapses, prompting leadership and legal reforms to give the supervisor “more bite”. Early signals indicated a tougher, more proactive regulatory environment: fines and public measures against institutions ranging from fintechs to large incumbents signaled that process and control weaknesses would draw supervisory attention.

By mid‑2025, BaFin formalized its forward‑looking posture in a strategic roadmap for 2026–2029. The plan orients supervision toward systemic risk prevention: strengthen financial stability; identify problem institutions early and act swiftly; bolster operational resilience; intensify the fight against financial crime and better integrate sustainability and innovation into day‑to‑day

supervision. The trajectory is a more assertive, data‑driven regulator mandated to safeguard market integrity and stability.

In a move that sent a clear signal to global banks, BaFin imposed a €45 million fine on J.P. Morgan’s German entity for systemic deficiencies in IT governance and data integrity related to regulatory reporting. This action powerfully reinforces BaFin’s new focus and proves that even the most sophisticated institutions are under scrutiny if their underlying data and IT systems are

not demonstrably robust and auditable.

The What: BaFin’s New Strategic Focus

BaFin’s strategic focus areas are the specific domains where its proactive doctrine is being actively enforced. These are high-priority areas examined during audits. The following five sections break down each of these high-priority domains in detail. Each one

provides a practical analysis of how BaFin’s new expectations are being applied in the real world audits.

Outsourcing and Third-Party Risk (DORA)

This focus marks a fundamental shift from merely documenting vendor relationships to proving operational resilience against third-party failure. Under the EU’s Digital Operational Resilience Act (DORA), vendor management is no longer a simple contract-review (SLA) task; it is a C-suite issue of business continuity.

Regulators are no longer just checking contracts. They are testing executable exit strategies and mapping concentration risk, for example, whether a bank is overly reliant on a single cloud provider for multiple critical functions. BaFin expects banks to maintain a dynamic, real-time outsourcing register (not a static PDF) and prove they can survive the sudden loss of a critical ICT provider without material disruption.

AML/CTF and STR Timeliness

The primary lesson from recent enforcement (e.g., N26, Solaris) is that timeliness is a non-negotiable outcome. BaFin’s ‘Risks in Focus 2025’ identifies inadequate money-laundering prevention as a critical risk. The regulator is using hard metrics to measure the time taken from alert generation to filing the Suspicious TransactionReport (STR).

Banks are being forced to move beyond static, rule-based systems, which often generate excessive false positives, and into behavioral models that efficiently isolate true risk. Critically, this process must retain human accountability. This means all automated systems must be transparent and support, not replace, the final

judgment of a qualified analyst.

Internal Governance and Reporting (Compliance Culture)

This focus area concerns the structural integrity and top-down commitment to compliance. Recent fines (e.g., UmweltBank) highlight that inadequate resourcing, incomplete board reports, or reporting gaps are treated as severe failures of governance, not mere administrative oversights.

BaFin expects the management board to be proactively engaged, demanding clear, measurable KPIs (like compliance action closure rates) that signal the health of the control environment.

This shifts board reporting from a retrospective explanation of what happened to a forward-looking risk management dashboard showing what is being done to prevent future breaches.

ESG and Sustainability Risks

BaFin expects Environmental, Social, and Governance (ESG) risks to be fully integrated into the bank’s core risk management framework (e.g., MaRisk), not treated as a peripheral marketing topic [13]. This means quantifying how climate change, transition risks, and social factors impact credit risk, operational resilience, and market positions.

For the compliance function, the emphasis is on evidential truthfulness. Claims of “green” or “sustainable” products must be substantiated with auditable data, preventing the legal and reputational risk of greenwashing and ensuring full compliance with disclosure rules.

Cybersecurity and Operational Resilience

Cyber incidents are now treated as immediate prudential concerns. Guided by BAIT (Bankaufsichtliche Anforderungen an die IT), BaFin expects banks to not only have detailed recovery plans (DR/BCP) but to rigorously test them and prove they can meet key metrics like Recovery Time Objective (RTO).

The introduction of DORA formalizes the need for rapid incident classification and timely notification to the regulator, turning every major cyber event into a critical compliance checkpoint. Banks must demonstrate architectural resilience and incident readiness (e.g., playbooks, drills) to prove they are not a weak link in the financial system.

The How: The Bank Imperative – A Blueprint for Modernization

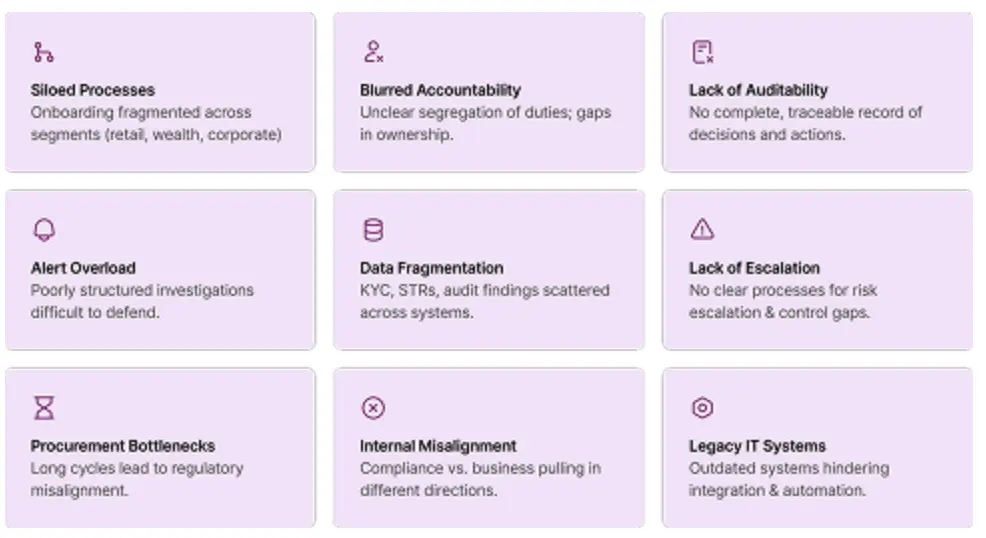

Achieving the transformative benefits of advanced regulatory technology (RegTech) is a complex challenge extending beyond mere software adoption. Before financial institutions can fully leverage cutting-edge solutions, banks must proactively address the deep-seated foundational workflow and organizational gaps that repeatedly undermine compliance efforts. These include siloed processes, such as fragmented onboarding, legacy IT systems that hinder automation and integration, procurement bottlenecks, and data fragmentation, among other major hurdles.

What can banks do to overcome these challenges and develop a robust strategy to mitigate audit risk while maintaining operational efficiency? The following steps are key components of any modernization initiative:

This actionable blueprint for modernization provides the framework for transforming compliance from a check-the-box cost center into a proactive, strategic capability. More than simply a list of new technologies banks should implement, the approach centers around the critical human and process-oriented foundations that are the prerequisites for any successful technology implementation. The following steps outline the path to building a defensible, efficient, and data-driven compliance function that satisfies regulators and creates lasting business value.

Designing Around the Core Stakeholders

Institutions that succeed orient their compliance processes around three stakeholder groups:

- Internal Teams: Relief from manual drudgery, structured workflows that create accountability, and free analysts to focus on genuine risk.

- Customers: Simple, transparent onboarding, with data collected once and reused across products.

- Auditors and Supervisors: Complete audit trails “from day one,” with centralized, retrievable records that cut weeks of manual evidence-gathering.

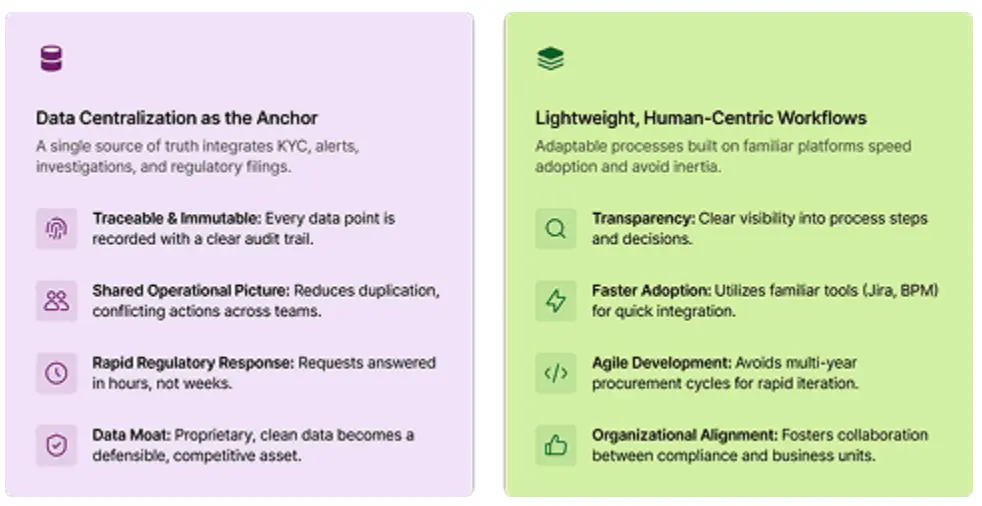

Data Centralization as the Anchor

At the heart of modern compliance is data centralization. Without a single source of truth, controls collapse under the weight of duplications, inconsistencies, and delays in retrieval. A centralized case management system integrates KYC, alerts, investigations, and regulatory filings into a single platform, ensuring that the centralized, clean, and proprietary data becomes the bank’s most valuable asset. It is the Institutional IP, the “raw material” that, when fed into analytical models, creates the “Data Moat”. It is the one asset competitors cannot replicate.

Lightweight, Human-Centric Workflows

Many banks benefit from lightweight workflows built on familiar platforms such as Jira, Azure Boards, BPM tools, and RPA. This approach increases transparency, accelerates adoption, and avoids multi-year procurement cycles.

Laying the Groundwork for a Long-Term Competitive Advantage

By addressing these fundamental steps as part of a long-term, robust compliance strategy, banks lay the groundwork for transformational changes such as re-engineered governance and internal culture. Without these foundational changes, even the most sophisticated AI or monitoring system risks being undermined by silos, politics, and fragmented evidence.

Banks seeking to mitigate regulatory exposure and thrive in a fast-evolving financial services sector should take meaningful steps to modernize their approach to compliance. Doing so is more than a means to lower the risk of audits or potential penalties from regulators, but a newfound opportunity to turn compliance into a competitive advantage and long-term revenue driver.

Key Points

- BaFin has shifted to a proactive supervisory model focused on early risk detection and systemic prevention of financial crime.

- The 2026 to 2029 strategy emphasizes that data integrity and IT governance are critical components of a robust AML framework.

- Enforcement actions, such as the 45 million Euro fine against J.P. Morgan, signal that technical deficiencies are treated as major compliance failures.

- The Digital Operational Resilience Act mandates that banks prove their ability to maintain AML controls despite third-party failures.

- Centralized data and modern behavioral modeling are now essential for meeting the regulator’s strict timelines for reporting suspicious activity.

Related Links

- BaFin Strategy for the Years 2026 to 2029

- FATF Mutual Evaluation of Germany on Money Laundering and Terrorist Financing

- European Commission Guidance on the Digital Operational Resilience Act

- Financial Intelligence Unit Germany Annual Reports and STR Guidelines

- The collapse of Wirecard

Other FinCrime Central Articles About Bafin

- Germany’s BaFin says senior bank staff should have better IT knowledge under new DORA rules

- BaFin Orders Special Supervisor for Payone Amid Compliance Deficiencies

- Leonteq Europe fined €35000 by Bafin as opaque AML contradictions deepen

Some of FinCrime Central’s articles may have been enriched or edited with the help of AI tools. It may contain unintentional errors.

Want to promote your brand, or need some help selecting the right solution or the right advisory firm? Email us at info@fincrimecentral.com; we probably have the right contact for you.