Money laundering risks in Turkey’s crypto market have been under growing scrutiny as adoption has surged. Turkey ranks among the largest global markets for cryptocurrency, fueled by the prolonged decline of the lira and widespread use of dollar-pegged stablecoins. While ordinary citizens seek protection from inflation, criminal actors have leveraged the same systems for illicit transfers, layering schemes, and cross-border transactions outside of regulatory visibility. Turkish officials argue that the absence of clear oversight leaves an open door for underground markets, illegal gambling networks, and international fraud rings.

Table of Contents

Money laundering risks in Turkey’s crypto market

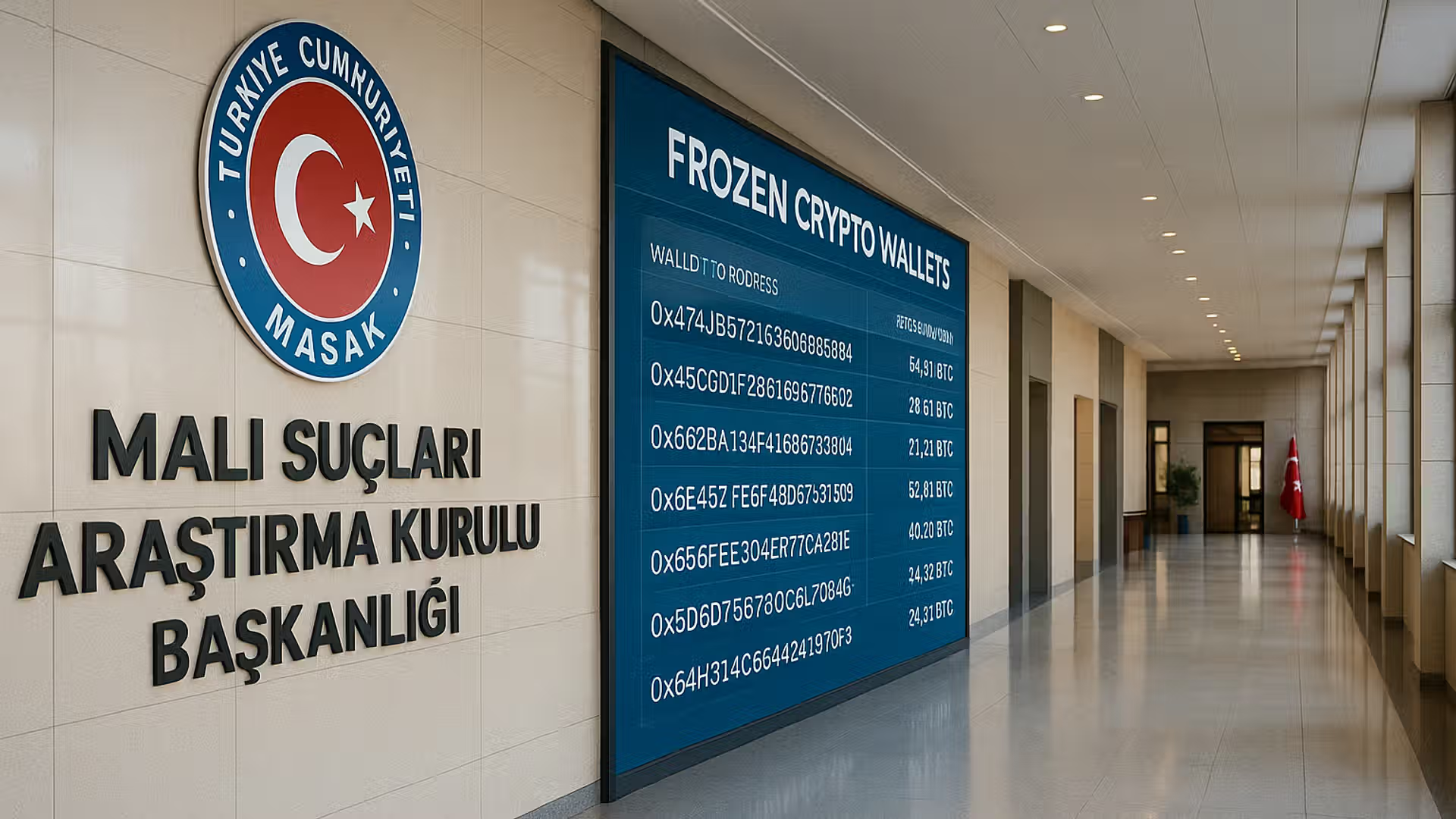

Masak, Turkey’s financial intelligence unit, already plays a central role in combating financial crime, but its mandate has traditionally focused on conventional banking. The proposed legislation marks a strategic expansion, allowing it to freeze cryptocurrency wallets alongside bank accounts. For anti-money laundering practitioners, this signals a significant shift: illicit finance involving digital assets is no longer seen as an isolated risk but part of the same continuum of threats that destabilize the wider economy.

Authorities have also drawn attention to the rise of “rented accounts,” in which individuals allow their payment channels to be used by criminals in exchange for small fees. These accounts have been tied to scams and laundering schemes designed to obscure the real origin of funds. By enabling Masak to freeze accounts quickly, Turkish lawmakers hope to cut off access before illicit networks can move funds offshore or convert them into privacy-focused assets.

Expanding regulatory control over digital assets

The legislation under discussion would not only empower Masak to freeze suspicious accounts but also extend compliance expectations across payment processors, banks, and crypto exchanges. This expansion aligns with global standards issued by the Financial Action Task Force, particularly the Recommendation 15 framework addressing new technologies. It highlights Turkey’s attempt to avoid being blacklisted by international partners and to demonstrate progress in plugging gaps that have drawn criticism in past evaluations.

Exchanges operating in Turkey would face tighter obligations to collect transaction data, scrutinize the purpose of transfers, and apply limits on large flows of stablecoins. This directly impacts platforms that have until now operated with relative freedom in onboarding customers. Peer-to-peer networks and decentralized exchanges pose additional complexity, as they often lack centralized operators subject to local jurisdiction. Turkish authorities have already taken steps to block access to some platforms that provide unlicensed services, signaling that future enforcement may expand to the technical infrastructure of the internet itself.

While cryptocurrency trading remains legal, the state’s growing appetite for intervention raises difficult questions about investor confidence. Critics warn that overreach could push legitimate activity further underground or drive platforms out of the Turkish market entirely. However, officials emphasize that the legislation is not a ban but a targeted tool to combat crime. The focus remains on accounts and wallets tied to gambling, fraud, and laundering networks rather than ordinary retail investors.

Implications for compliance and enforcement

For compliance teams, the proposed framework presents both new responsibilities and practical challenges. Freezing accounts across multiple asset types requires integration of monitoring systems that can link crypto wallets to fiat payment channels, customer identities, and suspicious activity reports. This is particularly difficult given the pseudonymous nature of blockchain transactions and the use of mixers or privacy coins.

If implemented effectively, the measure could strengthen Turkey’s ability to respond to complex laundering cases, where funds often shift rapidly between on-chain and off-chain environments. The capacity to impose transaction limits or blacklist wallets adds flexibility in disrupting ongoing activity, rather than relying solely on lengthy court proceedings. Still, enforcement depends heavily on the quality of data collected and the ability of regulators to act swiftly without stifling legitimate economic flows.

International observers note that Turkey’s move is consistent with a wider global trend of governments asserting more direct control over digital assets. Comparable approaches have been seen in East Asia, the Middle East, and parts of Europe, where financial intelligence units are being granted stronger freezing and investigative powers. This reflects an acknowledgment that criminal groups are quick to exploit regulatory arbitrage, moving assets into jurisdictions perceived as weakly supervised.

Cross-border cooperation and FATF alignment

The international community will closely monitor Turkey’s new legislative approach, especially given its status as a jurisdiction under enhanced monitoring by global standard setters in recent years. The decision to empower Masak aligns Turkey more directly with FATF priorities, particularly in relation to the Travel Rule and the obligation to track and report suspicious digital asset transactions across borders. This alignment is not only about technical compliance but also about political credibility, since Turkey has faced criticism in the past for insufficient AML enforcement. By acting now, the government signals its intent to rebuild trust and demonstrate seriousness in tackling the vulnerabilities created by high crypto adoption. Successful cooperation with international regulators and intelligence-sharing frameworks could transform Turkey from a perceived weak link into a contributor to regional stability in financial crime prevention.

Assessing the broader impact on financial crime prevention

The effectiveness of Turkey’s plan will ultimately be judged on whether it reduces the prevalence of laundering schemes that exploit crypto. Freezing wallets alone may not be sufficient if criminals adapt by shifting into decentralized protocols or layering funds across multiple platforms. However, the symbolic value of the legislation should not be underestimated. It signals that Turkey intends to align itself with international AML standards and is willing to confront the reputational risks that come with being seen as a hub for illicit crypto activity.

For financial institutions and global partners, this could improve confidence in cross-border cooperation and information sharing. Yet, there is also the risk of unintended consequences, particularly if rules are applied unevenly or weaponized in politically sensitive cases. Independent oversight and transparency will be essential to ensure that the freezing powers are used proportionally and targeted only at accounts with demonstrable links to illicit finance.

The rise of cryptocurrency in Turkey has been deeply intertwined with economic instability, driving adoption among ordinary citizens while simultaneously creating opportunities for criminals. By empowering Masak to act decisively, lawmakers hope to strike a balance between enabling access to digital finance and closing loopholes that undermine the integrity of the financial system. Whether this balance can be maintained will depend on rigorous enforcement, international cooperation, and continued adaptation to the evolving tactics of money launderers.

Related Links

- Financial Action Task Force (FATF)

- Turkish Financial Crimes Investigation Board (Masak)

- Grand National Assembly of Turkey

- Capital Markets Board of Turkey

- European Banking Authority

Other FinCrime Central News About Turkey

- US Crackdown on Hamas Virtual Currency Reveals Turkey’s Role in Terrorism Financing

- Turkey’s Bold Crypto AML Rules for 2025

- Turkish prosecutors dismantle Can Holding’s laundering web

Source: COINTELEGRAPH, by Sam Bourgi

Some of FinCrime Central’s articles may have been enriched or edited with the help of AI tools. It may contain unintentional errors.

Want to promote your brand, or need some help selecting the right solution or the right advisory firm? Email us at info@fincrimecentral.com; we probably have the right contact for you.