Category: Transaction Monitoring

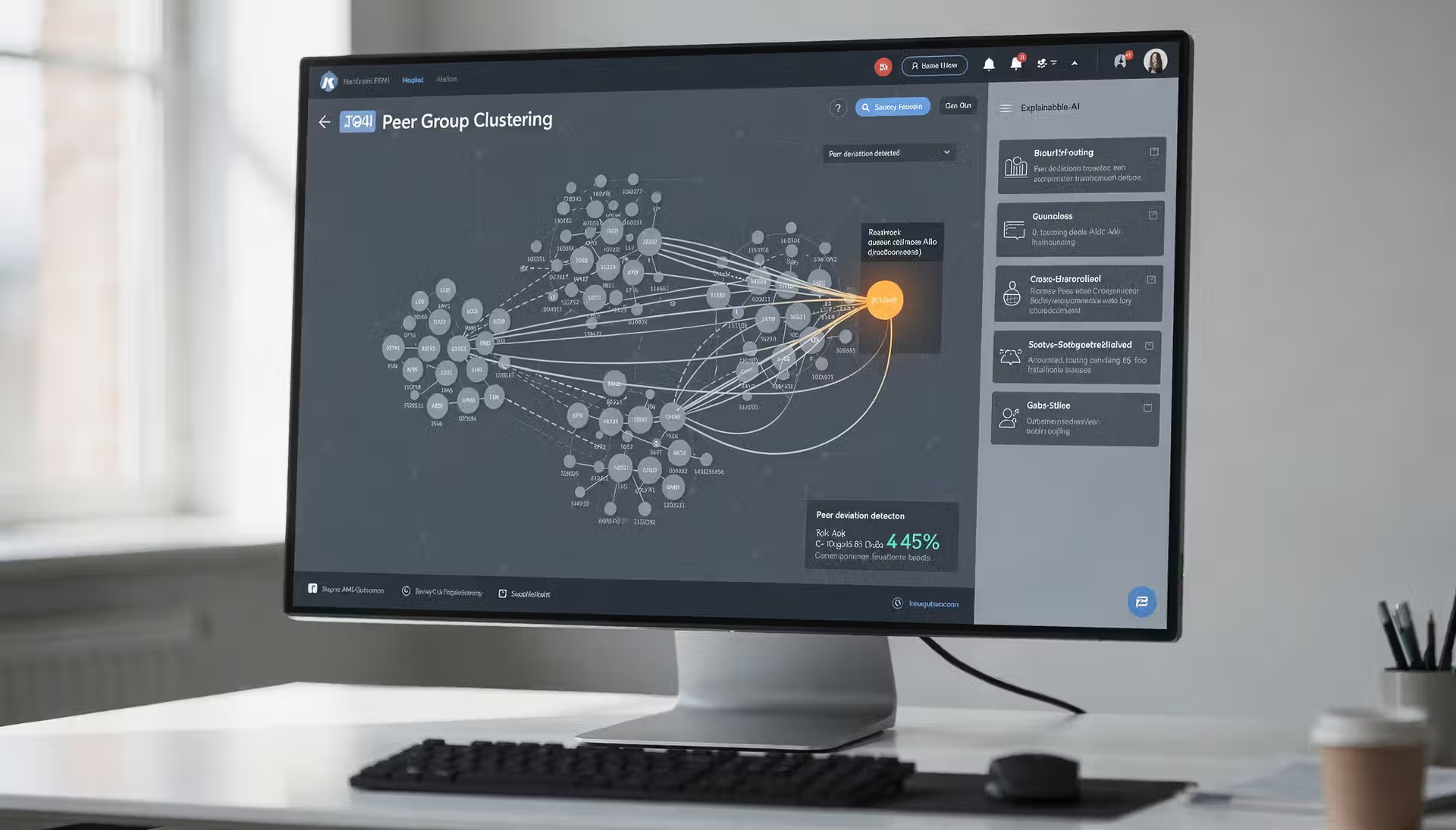

Advancing Financial Integrity through AI Peer Group Comparison

Discover how AI Peer Group Comparison is changing transaction monitoring and the risks that biased data sets pose to financial institutions globally.

Read MoreCSSF, the Luxembourg Regulator, Fines Rakuten Europe Bank for AML Failures

The CSSF has fined Rakuten Europe Bank €185,000 for failing to maintain an adequate transaction monitoring system and neglecting critical sanctions alerts.

Read MoreCredit Suisse NY Faces 7M$ Fine For Systemic Transaction Monitoring Failures

Credit Suisse must pay a 7,125,000 dollar fine due to a failure in Systematic Surveillance Reliability that left 900 million records unmonitored.

Read MoreFINRA Fines Mundial Financial Group $100,000 for AML Program Failures

FINRA fined Mundial Financial Group $100,000 after identifying AML compliance failures broker dealer controls that left high risk customers and suspicious trading activity insufficiently monitored.

Read MoreFCA Slams Nationwide With Major £44M Fine

The FCA levied a £44 million penalty against Nationwide for inadequate anti-money laundering systems and controls between 2016 and 2021, driven by failures in customer due diligence and transaction monitoring. This action, stemming from a serious case involving £27.3 million in fraudulent funds, highlights the severe consequences of failing to manage financial crime risk.

Read More

Advancing Financial Integrity through AI Peer Group Comparison

Discover how AI Peer Group Comparison is changing transaction monitoring and the risks that biased data sets pose to financial institutions globally.

Read MoreCSSF, the Luxembourg Regulator, Fines Rakuten Europe Bank for AML Failures

The CSSF has fined Rakuten Europe Bank €185,000 for failing to maintain an adequate transaction monitoring system and neglecting critical sanctions alerts.

Read MoreCredit Suisse NY Faces 7M$ Fine For Systemic Transaction Monitoring Failures

Credit Suisse must pay a 7,125,000 dollar fine due to a failure in Systematic Surveillance Reliability that left 900 million records unmonitored.

Read MoreFINRA Fines Mundial Financial Group $100,000 for AML Program Failures

FINRA fined Mundial Financial Group $100,000 after identifying AML compliance failures broker dealer controls that left high risk customers and suspicious trading activity insufficiently monitored.

Read MoreFCA Slams Nationwide With Major £44M Fine

The FCA levied a £44 million penalty against Nationwide for inadequate anti-money laundering systems and controls between 2016 and 2021, driven by failures in customer due diligence and transaction monitoring. This action, stemming from a serious case involving £27.3 million in fraudulent funds, highlights the severe consequences of failing to manage financial crime risk.

Read More

Advancing Financial Integrity through AI Peer Group Comparison

Discover how AI Peer Group Comparison is changing transaction monitoring and the risks that biased data sets pose to financial institutions globally.

Read MoreCSSF, the Luxembourg Regulator, Fines Rakuten Europe Bank for AML Failures

The CSSF has fined Rakuten Europe Bank €185,000 for failing to maintain an adequate transaction monitoring system and neglecting critical sanctions alerts.

Read MoreCredit Suisse NY Faces 7M$ Fine For Systemic Transaction Monitoring Failures

Credit Suisse must pay a 7,125,000 dollar fine due to a failure in Systematic Surveillance Reliability that left 900 million records unmonitored.

Read MoreFINRA Fines Mundial Financial Group $100,000 for AML Program Failures

FINRA fined Mundial Financial Group $100,000 after identifying AML compliance failures broker dealer controls that left high risk customers and suspicious trading activity insufficiently monitored.

Read MoreFCA Slams Nationwide With Major £44M Fine

The FCA levied a £44 million penalty against Nationwide for inadequate anti-money laundering systems and controls between 2016 and 2021, driven by failures in customer due diligence and transaction monitoring. This action, stemming from a serious case involving £27.3 million in fraudulent funds, highlights the severe consequences of failing to manage financial crime risk.

Read More