Financial crime poses a continuous, global threat requiring advanced detection and prevention methods, but Bulgaria has taken a significant step by focusing on the proficient use of Open-Source Intelligence (OSINT) to strengthen its AML/CFT capabilities. The effectiveness of any Anti-Money Laundering or Counter-Financing of Terrorism, AML/CFT, regime depends heavily on the capabilities of its Financial Intelligence Units and law enforcement agencies. These authorities must continuously update their methodologies to counter the sophisticated tactics employed by criminal organizations attempting to integrate illicit proceeds into the legitimate financial system. The adoption of OSINT has become a pivotal element in this ongoing battle against illicit finance. This intelligence, gathered from publicly available sources, offers crucial, real-time insights for uncovering complex money laundering networks and emerging risk typologies.

Table of Contents

Strengthening Open-Source Intelligence for Financial Crime

The Council of Europe has been instrumental in assisting Bulgarian national authorities to enhance their capacity for employing modern analytical tools in their fight against financial crime. Building on earlier foundational training, an advanced program was conducted in Sofia in October 2025. This targeted two-day training, organized at the request of the beneficiaries, brought together analysts, investigators, and prosecutors from the Financial Intelligence Unit, law enforcement, and prosecution services. The objective was to deepen the practical skills of practitioners and ensure the proper integration of OSINT techniques into the respective institutional processes across the country.

The initial phase of the training concentrated on developing operational OSINT skills vital for day-to-day enforcement. This included the practical use of specific OSINT tools for the critical functions of red flag identification, immediate threat detection, and national or regional risk mapping. Participants engaged in interactive, scenario-based exercises designed to mimic real-world analytical requests, forcing them to identify relevant indicators, formulate operational objectives, and develop actionable recommendations. Furthermore, the session provided a crucial review of the main legal and operational foundations governing the use of OSINT by AML/CFT authorities, placing emphasis on necessary conditions and legal safeguards for its practical application. The shift toward systematic operational deployment of OSINT enhances the ability to monitor transactions and entities that might be exploiting vulnerabilities in the financial system.

Transitioning to Strategic Analytical Frameworks

The second phase of the advanced program moved beyond tactical case-level analysis, focusing instead on the strategic applications of OSINT. Strategic analysis involves assessing higher-level, systemic threats and understanding the pervasive risks stemming from broader global and regional geopolitical drivers. This level of insight is necessary for developing effective, long-term national AML/CFT policies and resource allocation.

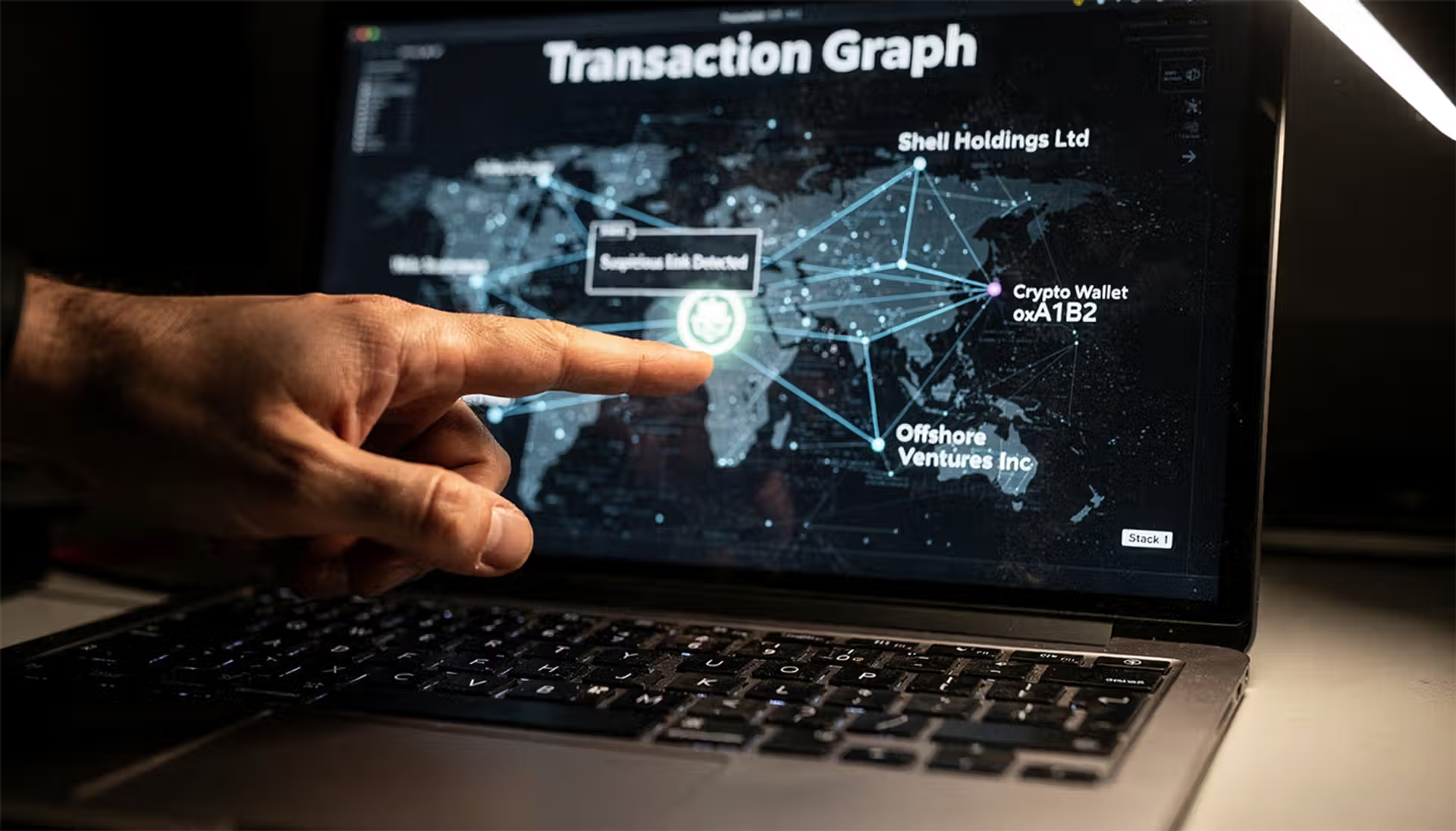

The training explored specific, advanced OSINT analysis techniques such as thematic coding, which enables analysts to identify recurring patterns and connections within vast amounts of open-source data. Practical exercises applied these methods to real-world data, demonstrating how high-level analysis informs strategic decision-making. A significant component of this strategic focus involved discussing analytical frameworks for selected money laundering typologies, notably those associated with cryptocurrency. The use of virtual assets presents distinct challenges to traditional financial intelligence, and OSINT is particularly valuable for tracing on-chain activity and identifying associated real-world entities. By understanding these new typologies at a strategic level, authorities can proactively design controls and allocate resources to counter emerging threats before they become embedded systemic risks. This advancement in skill sets enables a shift from purely reactive investigations to a more proactive, risk-based supervisory model, which is the international standard promoted by bodies like the Financial Action Task Force, FATF.

Fostering Enhanced Inter-Agency Cooperation

A key takeaway from the Bulgarian training initiative was the emphasis on fostering enhanced inter-agency cooperation. The event deliberately brought together a diverse group of 25 practitioners from financial intelligence, law enforcement, and prosecution services. This varied, multi-agency composition in a dynamic setting promoted constructive exchanges and mutual learning, directly addressing a common challenge in AML/CFT enforcement: the siloed nature of operations. Effective money laundering investigations require seamless, rapid exchange of information and shared analytical understanding between those who identify suspicious activity, those who investigate the crimes, and those who prosecute the offenders.

The final, integrated simulation exercise was designed to mirror the complex interactions of real-world AML/CFT scenarios. Different groups were assigned distinct but interconnected analytical tasks, demonstrating precisely how tactical, operational, and strategic levels must interact in practice to achieve a complete and successful outcome. For instance, a tactical OSINT finding might lead to an operational insight about a specific criminal network, which in turn informs a strategic decision on the vulnerability of a specific sector. By integrating these analytical levels and fostering shared understanding across the national authorities, the initiative significantly contributed to strengthening Bulgaria’s institutional capacity to use OSINT more effectively across the entire spectrum of its AML/CFT operations. The result is a more cohesive and formidable national response to sophisticated financial crime, ensuring that intelligence is not just collected but is also translated efficiently into impactful enforcement action and policy adjustment.

A Cohesive Approach to Illicit Finance

The advanced training program for Bulgarian authorities, supported by the European Union and the Council of Europe through the Technical Support Instrument, marks a crucial milestone in the evolution of the national AML/CFT regime. The initiative successfully transitioned participants from a purely case-level, tactical mindset to one that incorporates broader operational and strategic insights. By integrating advanced OSINT skills, the Financial Intelligence Unit and its law enforcement partners are better equipped to identify and dismantle increasingly complex money laundering schemes. This includes the identification of red flags associated with various typologies, the effective mapping of financial crime risk, and the ability to formulate actionable intelligence for investigations and prosecutions. This proactive approach strengthens the national ability to safeguard the integrity of the financial system against the proceeds of all serious crimes, in line with international standards. The focus on inter-agency cooperation ensures that these enhanced skills are applied across the entire enforcement pipeline, maximizing the deterrent and disruptive effect on criminal organizations. This sustained capacity building is essential for any modern jurisdiction committed to tackling the pervasive challenge of illicit finance.

Key Points

- The Bulgarian training focused on enhancing Open-Source Intelligence skills for AML/CFT.

- The initiative covered both operational OSINT for tactical analysis and strategic OSINT for higher-level risk assessment.

- Advanced techniques like thematic coding and analysis of cryptocurrency-related money laundering typologies were discussed.

- A primary goal was fostering enhanced inter-agency cooperation between the Financial Intelligence Unit, law enforcement, and prosecutors.

- This capacity building strengthens Bulgaria’s ability to move from reactive investigations to a proactive, risk-based approach against financial crime.

Related Links

- Financial Action Task Force, FATF, Recommendations

- Council of Europe Convention on Laundering, Search, Seizure and Confiscation of the Proceeds from Crime

- European Union AML Directive, Latest Version

- Bulgarian Financial Intelligence Unit Official Website

- The Role of Open-Source Intelligence in AML Compliance and Investigations

Other FinCrime Central Articles Talking About OSINT

Source: Council of Europe

Some of FinCrime Central’s articles may have been enriched or edited with the help of AI tools. It may contain unintentional errors.

Want to promote your brand, or need some help selecting the right solution or the right advisory firm? Email us at info@fincrimecentral.com; we probably have the right contact for you.