Law enforcement agencies in France and Romania, supplemented by Europol and Eurojust, dismantled a criminal network involved in laundering 306 million euros through drug trafficking and tax evasion. The coordinated operation on February 3rd, 2026, resulted in thirteen arrests and the seizure of substantial luxury assets and cash. Investigators uncovered a complex financial system designed to legitimise illicit proceeds using fake invoices and corporate front companies. This international cooperation was facilitated by Eurojust to bridge the legal gaps between jurisdictions during a multiyear investigation. The case highlights the growing scale of transnational financial crime within the European Union and the necessity of joint task forces to secure evidence across borders.

Table of Contents

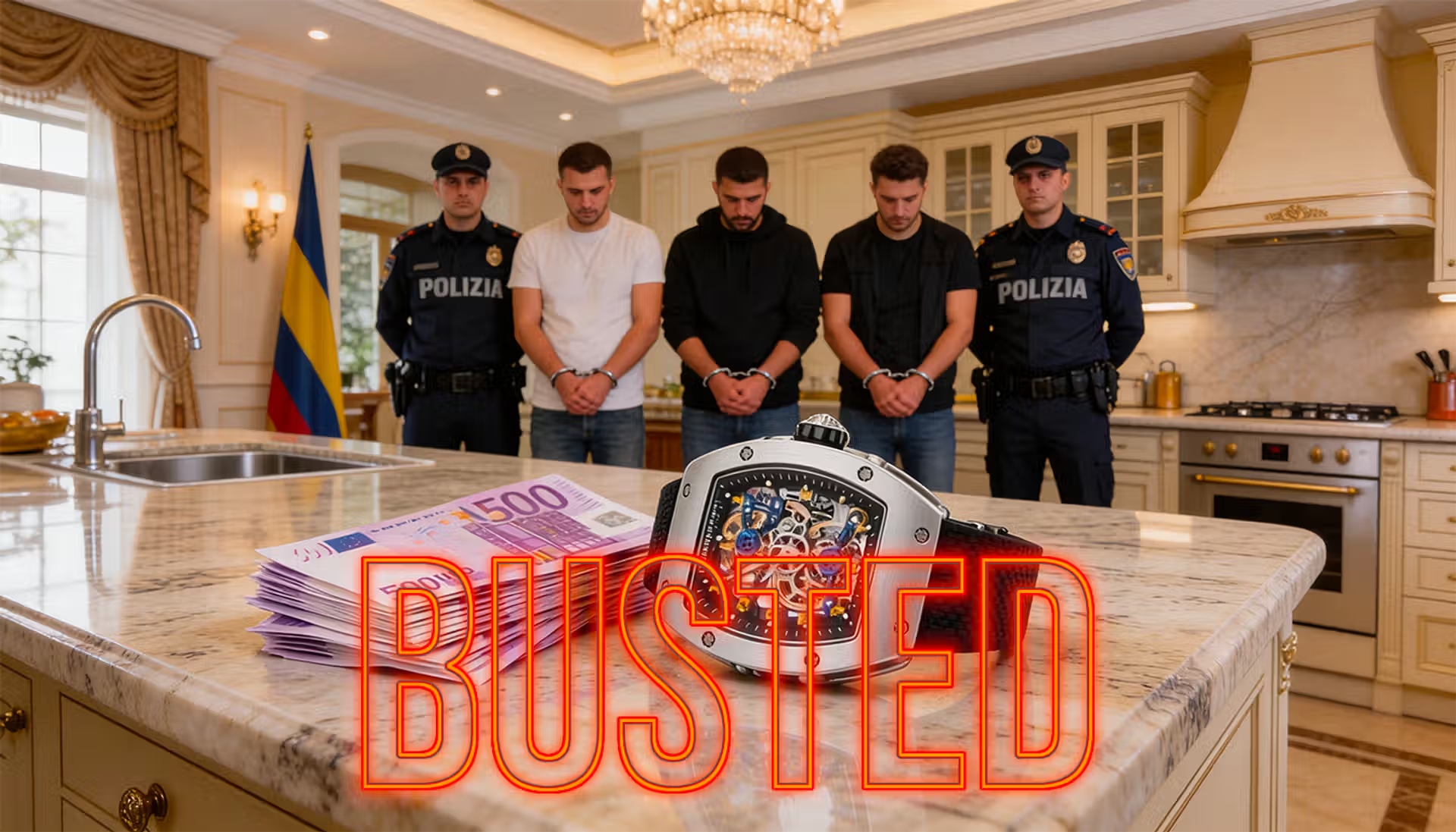

Action against EUR 306 million money laundering network

The dismantling of a massive criminal organization capable of processing hundreds of millions of euros represents a significant victory for European financial regulators. This specific network operated for at least six years, from 2018 until early 2024, utilizing the legal frameworks of both France and Romania to obscure the origins of criminal cash. The primary mechanism of this operation involved the strategic takeover of legitimate legal entities within France. By controlling these businesses, the syndicate could move money through official banking channels with less scrutiny than individual transfers might trigger. These companies were not merely shells; they were active participants in a sophisticated financial circuit designed to deceive tax authorities and bank compliance officers.

The scale of the 306 million euro figure illustrates the volume of illicit traffic, primarily sourced from narcotics sales, that requires sophisticated cleaning before it can enter the legitimate economy. In this instance, the criminals did not rely on simple cash smuggling; instead, they built a corporate infrastructure. The issuance of false invoices for fictitious services allowed the group to move money between entities while simultaneously reducing the taxable income of the participating firms. This double benefit provided both the laundering service and a tax evasion mechanism, making the scheme highly attractive to organized crime members. Each invoice created a paper trail that appeared legitimate on the surface but lacked any underlying economic substance.

Tactical Use of Cross-Border Real Estate Investments

Once the funds were moved through the French corporate structure, the criminal group sought to park its wealth in permanent assets. Romania served as the primary destination for these capital investments, particularly within the real estate sector. Property has long been a favored asset class for money launderers because of its ability to absorb large sums of money and its potential for value appreciation. To further distance the criminal leadership from the assets, the group utilized straw buyers or associates to hold titles. By placing apartments, houses, and commercial plots in the names of family members or lower-level associates, the primary architects of the scheme hoped to avoid detection by anti-money laundering software and manual audits.

This layered approach to ownership is a classic technique in global financial crime. It exploits the privacy laws and property registration systems of sovereign states. In this case, the investigation revealed that the syndicate had dozens of members, each playing a specific role in the acquisition and management of these Romanian properties. The geographical spread of the searches, which included regions like Cluj and Maramures, indicates that the investment strategy was not localized but spanned across the country. The integration of illicit funds into the real estate market not only distorts local property prices but also provides a stable, clean income stream for criminals once those properties are rented or sold later.

Collaborative Law Enforcement and Financial Intelligence

The success of the operation on 3 February was the result of a joint investigation team funded and coordinated by Eurojust in The Hague. This framework allowed French investigative judges and the National Prosecutor’s Office Against Organised Crime to work seamlessly with the Romanian Directorate for Investigating Organised Crime and Terrorism. Without such a formal agreement, the exchange of banking records and surveillance data would have been bogged down by the slow processes of traditional mutual legal assistance treaties. The joint team enabled real-time intelligence sharing, which was crucial for tracking the movement of the 306 million euros as it flowed through different bank accounts.

During the coordinated action day, authorities carried out twenty-four house searches, which yielded 400,000 euros in immediate cash and various high-value items. The seizure of luxury watches, jewelry, and mobile phones provides critical physical evidence that complements the digital and paper trails of the false invoices. Mobile phones, in particular, often contain the communication logs and encrypted messages necessary to prove intent and conspiracy among the thirteen arrested individuals. These physical assets also represent a portion of the criminal profit that will now be subject to forfeiture proceedings, preventing the syndicate from using those resources to rebuild their operations from behind bars.

Long-Term Impact on Regional Financial Security

The removal of this network disrupts a major artery for drug money in Western Europe. By targeting the professional launderers who facilitate the movement of cash, law enforcement hits the most vulnerable point of the organized crime business model. Without a reliable way to clean their profits, drug trafficking organizations face higher risks and lower liquidity. This case serves as a warning to those providing corporate services to criminals, showing that the misuse of French legal entities and the Romanian property market is being monitored with increasing sophistication. The use of financial investigation units like the BRIF in Paris highlights the move toward specialized units that focus purely on the money rather than just the underlying predicate offenses.

The ongoing judicial proceedings will likely focus on the complexity of the fake invoice system. Proving that services were never rendered requires a deep dive into corporate accounting and vendor histories. However, the sheer volume of funds moved, 306 million euros, makes the case a landmark in recent Franco-Romanian legal history. It underscores the necessity for continuous vigilance in the monitoring of new corporate registrations and the sudden takeover of existing small businesses. As criminal groups become more adept at mimicking legitimate business practices, the tools used by regulators and prosecutors must also evolve to detect these subtle deviations in financial behavior across the European Economic Area.

Key Points

- Law enforcement dismantled an international network that laundered 306 million euros through corporate entities and real estate.

- The syndicate utilized a system of false invoices for fictitious services to reduce taxable income and move illicit funds between France and Romania.

- Thirteen suspects were arrested during a coordinated action day involving twenty-four house searches and the seizure of cash and luxury goods.

- A joint investigation team facilitated by Eurojust allowed for the seamless exchange of evidence and intelligence between French and Romanian authorities.

- Illicit profits were primarily sourced from drug trafficking and were hidden using third-party names for property investments in Romania.

Related Links

- FATF Guidance on Money Laundering Risks in Real Estate

- French National Prosecutor Office Against Organised Crime Official Site

- Romanian Directorate for Investigating Organised Crime and Terrorism Announcements

- Europol Financial and Economic Crime Centre Reports

Other FinCrime Central Articles About Recent Europol / Eurojust Wind

- Criminal empire of fake investment crypto platforms finally dismantled by Europol

- Europol’s Operation Olympia Halts EUR 25 Million Cryptomixer Laundering Scheme

- Operation Endgame Shuts Down 1025 Servers in Laundering Crackdown

Source: Eurojust

Some of FinCrime Central’s articles may have been enriched or edited with the help of AI tools. It may contain unintentional errors.

Want to promote your brand, or need some help selecting the right solution or the right advisory firm? Email us at info@fincrimecentral.com; we probably have the right contact for you.